Fiscal Localization packages

to match your country's requirements.

The Egyptian localization package includes a standard chart of accounts, Egypt-ETA related accounts are already preset and in all databases for Egypt companies. It can be used directly, or it can be modified according to your company's needs.

The package also includes all the necessary taxes you need to comply with the government's regulations. All Value-added taxes, Withholding, Stamp, and Schedule taxes are captured in transactions, recorded on the correct accounts, and reflected in their corresponding tax reports. Odoo is fully integrated into the Egypt Tax Authority portal, where invoices can be sent to the ETA portal with a click of a button! The E-invoicing feature is fully functioning in Egypt for customer invoices for companies and individuals. Invoice signing is also available without any additional cost.

Looking for our simplified Invoicing app?

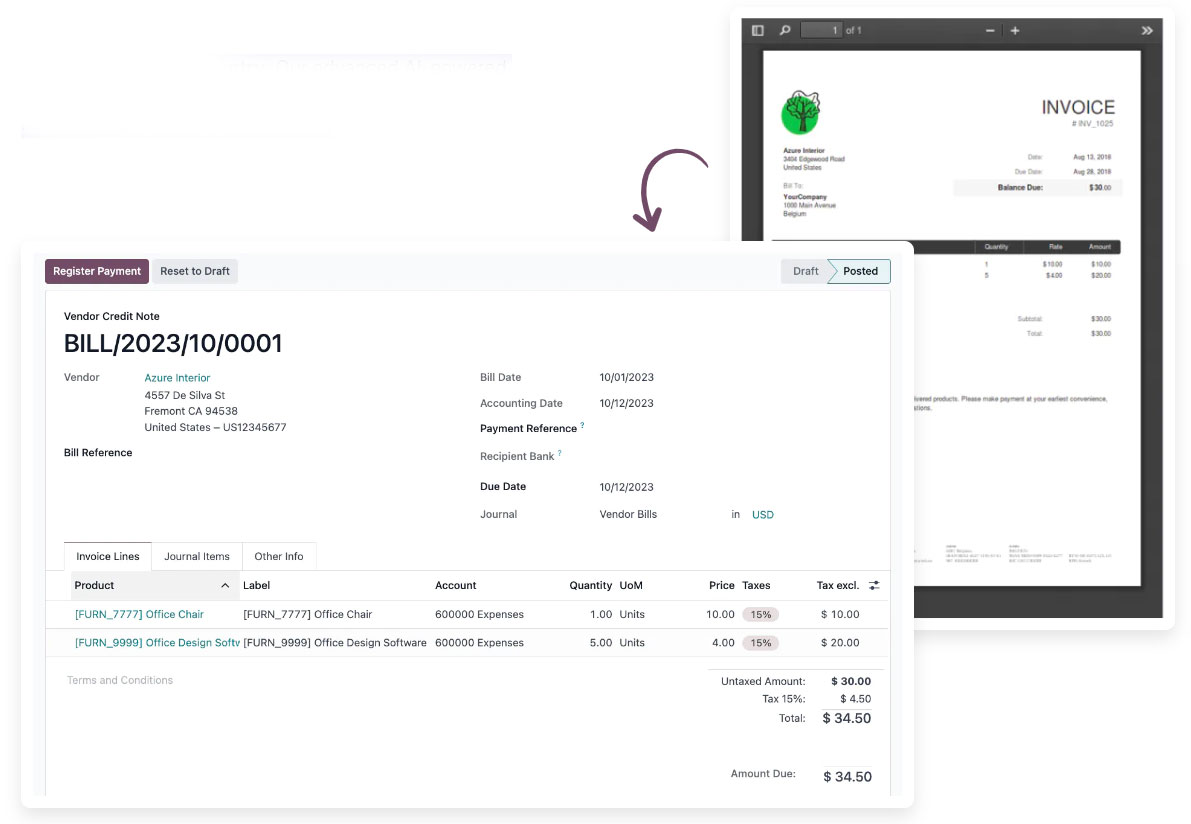

No data entry!

Just automation

Experience zero data entry. Our advanced AI-powered invoice data capture has a 98% recognition rate. All you have to do is to validate the invoice.

Enjoy the mobile experience

Your mobile companion. Take pictures of your expenses, and let the Artificial Intelligence do the rest!

All the features done right.

Worldwide compatibility

Odoo is pre-configured to address your country's* requirements: charts of accounts, taxes, country-specific reports, electronic invoicing, audit files, and fiscal positions to automatically apply the right tax rates and accounts.

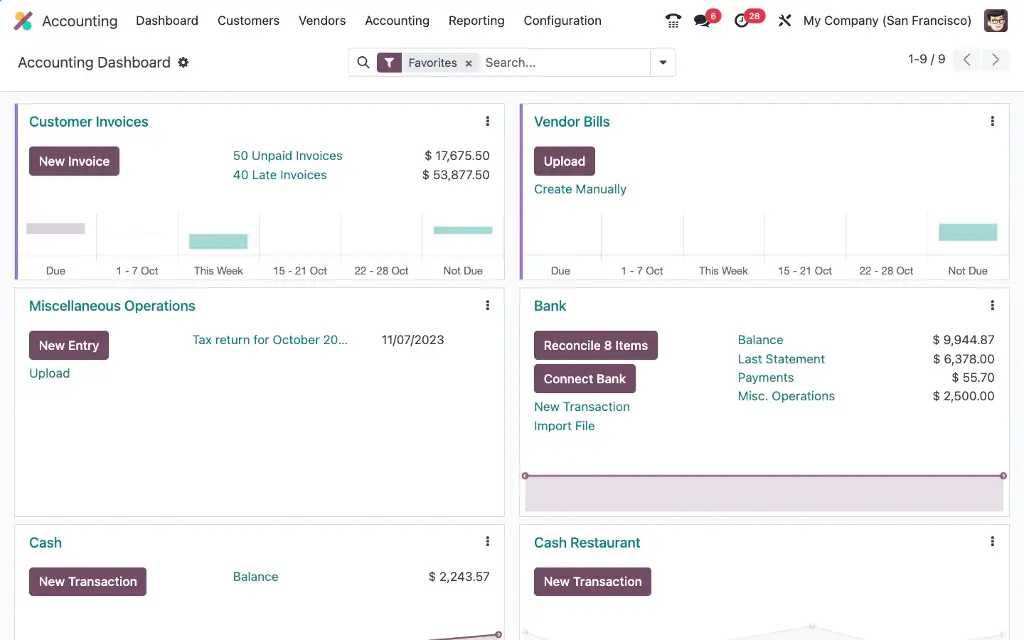

Real-time reporting

Real-time financial performance reports, empower you to make informed decisions for your business. Additionally, you can easily annotate, export, and access detailed information for each report.

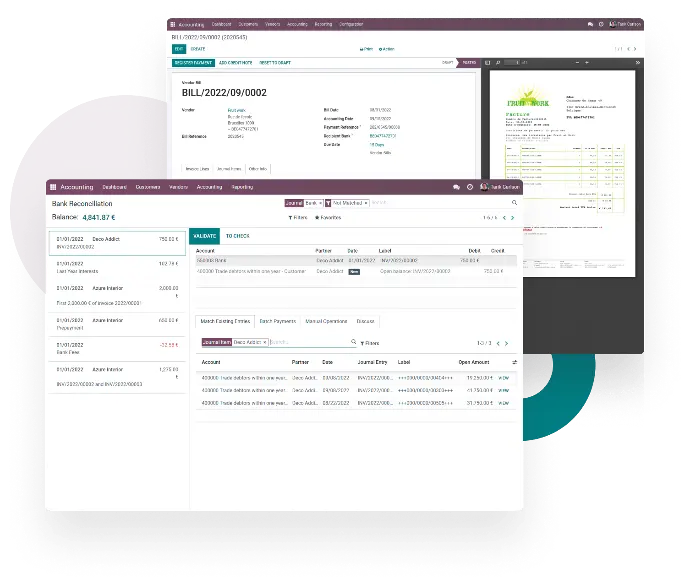

Electronic invoicing (EDI)

Various EDI file formats are available depending on your company's country. Send and receive electronic invoices in multiple formats and standards, such as Peppol

Automated follow-ups

Odoo helps you identify late payments and allows you to schedule and send the appropriate reminders based on the number of days overdue. You can send your follow-ups via different means, such as email, post, or SMS.

Deferrals

Defer your revenues and expenses, either manually or on each invoice/bill validation. You can also audit the entries from dedicated reports.

Dynamic taxes and accounts

No matter where your customers and suppliers are established, if they have a Tax ID or not, if the goods are sold cross-border, Odoo computes the right taxes and income or expense accounts.